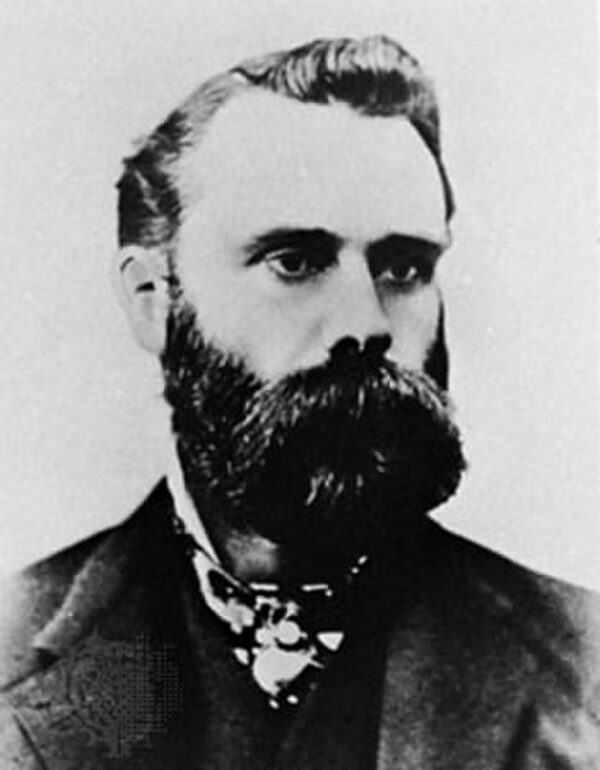

On May 26, 1896, Charles Dow, a pioneering financial journalist, and co-founder of Dow Jones & Company, published the first edition of the Dow Jones Industrial Average (DJIA). This seminal event marked a turning point in financial reporting and market analysis, establishing a new standard for tracking the performance of the industrial sector of the American economy.

Charles Dow, along with Edward Jones and Charles Bergstresser, founded Dow Jones & Company in 1882. Dow, an editor at The Wall Street Journal, sought to create a tool that would provide investors with a clear, concise measure of the stock market’s overall health. His innovation was the Dow Jones Industrial Average, an index that initially comprised 12 companies primarily involved in industrial activities, reflecting the industrial economy’s growing significance in the United States.

The original composition of the DJIA included companies such as American Cotton Oil, American Sugar, American Tobacco, Chicago Gas, Distilling & Cattle Feeding, General Electric, Laclede Gas, National Lead, North American, Tennessee Coal & Iron, U.S. Leather, and U.S. Rubber. These companies were selected for their prominence and representativeness of the industrial sector, which was rapidly transforming America’s economic landscape during the late 19th century.

Dow’s methodology for calculating the DJIA was straightforward but innovative. He averaged the stock prices of the 12 selected companies, providing a single figure that represented the market’s performance. Initially, the index stood at 40.94 points. Dow’s approach was based on his belief that stock prices reflected the collective wisdom and economic activities of investors, thereby serving as a barometer for the overall economy.

The creation of the DJIA was revolutionary in several ways. First, it offered a systematic method for tracking market performance, which was previously difficult for individual investors to gauge accurately. Before the DJIA, market information was often fragmented and inconsistent, making it challenging to discern broader market trends. The DJIA’s daily publication in The Wall Street Journal provided timely and reliable data, democratizing financial information for a wider audience.

Second, the DJIA established a foundation for modern financial journalism and analysis. Dow’s editorial work at The Wall Street Journal, combined with the DJIA, laid the groundwork for future financial indices and market metrics. The DJIA demonstrated the value of objective, data-driven analysis in financial reporting, influencing the development of similar indices worldwide.

Over time, the DJIA has undergone significant changes, reflecting the evolving nature of the American economy. The composition of the index has been periodically updated to include more companies and sectors, expanding beyond its original industrial focus to encompass a broader spectrum of the economy. Despite these changes, the DJIA has remained a vital tool for investors and economists, offering insights into market trends and economic conditions.

The introduction of the DJIA also highlighted the role of technological advancements in financial markets. During Dow’s era, the telegraph and ticker tape machines were instrumental in disseminating stock prices, enabling the real-time calculation of the index. This emphasis on technology and timely information dissemination continues to be a hallmark of financial markets today, with digital platforms and high-frequency trading shaping modern trading environments.

Charles Dow’s publication of the first edition of the Dow Jones Industrial Average on May 26, 1896, was a landmark event in financial history. It provided a novel and effective means of measuring market performance, fostering greater transparency and accessibility in financial markets. The DJIA’s enduring significance is a testament to Dow’s vision and innovation, continuing to serve as a critical indicator of economic health and market trends well into the 21st century.