Black Thursday, October 24, 1929, marks one of the most infamous days in financial history. It was the start of the catastrophic stock market crash that led to the Great Depression, a period of prolonged economic hardship in the United States and globally. While Black Thursday wasn’t the only day of the crash, it was the day panic truly set in, sparking a series of events that would ultimately reshape financial markets and economic policies for decades to come.

Leading up to Black Thursday, the 1920s had been a period of incredible growth and optimism. Dubbed the “Roaring Twenties,” this era was characterized by technological innovation, industrial expansion, and a booming stock market. American industries like automobile manufacturing, construction, and consumer goods were flourishing. As people grew wealthier, they became more willing to invest in stocks. The New York Stock Exchange (NYSE) was seen as a surefire way to get rich quickly, and stock prices soared.

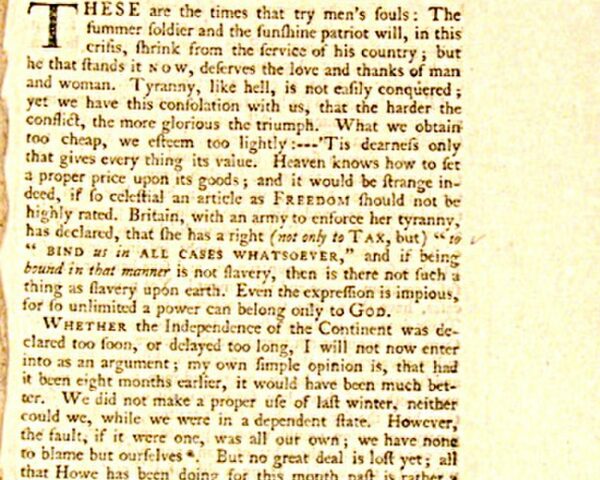

However, much of this stock market growth was built on shaky ground. Speculative investments fueled by margin buying—where investors borrowed money to purchase stocks—were rampant. Investors only needed to put down 10% of the stock’s price and borrow the rest. As long as stock prices kept rising, this strategy worked, but it also created a fragile bubble. Many stocks were wildly overvalued, and there were warning signs that the market was unsustainable. Nonetheless, most investors and analysts ignored these warnings, convinced the market could only go up.

By mid-1929, cracks in the economic system were starting to show. Industrial production began to slow, car sales dropped, and consumer debt was on the rise. Despite this, the stock market continued to climb, buoyed by the widespread belief in endless prosperity. This disconnect between stock prices and the underlying economy set the stage for disaster.

In early October, the stock market began to show signs of weakness. On October 23, the day before Black Thursday, the market experienced a sharp decline. This drop unnerved investors, but few could have predicted the panic that was about to unfold.

On the morning of October 24, 1929, panic hit the New York Stock Exchange. Investors, fearing further losses, began to sell their stocks at a frantic pace. By the end of the day, a record 12.9 million shares had been traded, an unprecedented number at the time. Stock prices plummeted, wiping out billions of dollars in wealth in just hours.

To stabilize the market, a group of leading bankers, including Charles E. Mitchell of National City Bank and Thomas W. Lamont of J.P. Morgan, met to try to calm the panic. They pooled their resources and began buying large quantities of blue-chip stocks to restore confidence. Their efforts temporarily stopped the slide, and the market recovered slightly by the end of the day. However, the damage was done, and the sense of security in the stock market was shattered.

While Black Thursday saw a slight recovery, it was only a brief respite. The market crashed again on Monday, October 28, and even more dramatically on Tuesday, October 29, a day that became known as “Black Tuesday.” By the end of 1929, the stock market had lost almost half its value from its peak earlier in the year.

The stock market crash had far-reaching effects. Banks failed, businesses went bankrupt, and unemployment skyrocketed. The crash not only devastated the U.S. economy but also sent shockwaves through global markets, contributing to the onset of the Great Depression. The economic hardships of the Great Depression lasted for more than a decade, leading to widespread poverty and political instability. In response, governments around the world, including the U.S., implemented new financial regulations to prevent such a catastrophe from happening again. These reforms included the Glass-Steagall Act, which separated commercial and investment banking, and the creation of the Securities and Exchange Commission (SEC) to regulate the stock market.

Black Thursday was the beginning of a financial disaster that changed the world. It exposed the dangers of speculative investing and the fragility of an unregulated stock market. The lessons learned from that fateful day led to reforms that still shape financial markets today.