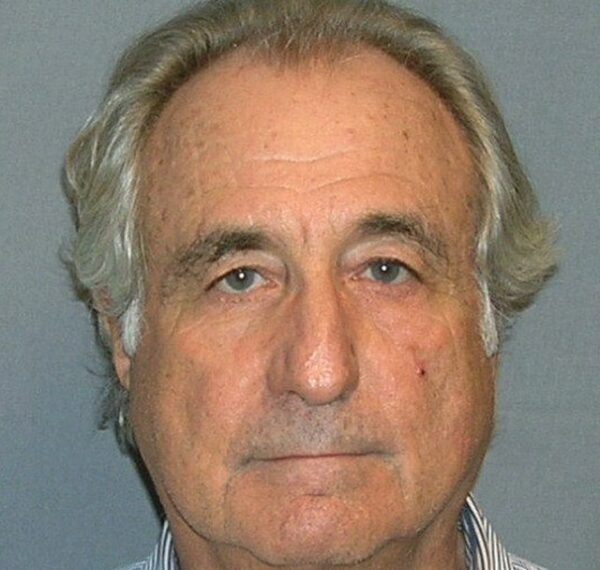

On March 12, 2009, Bernard L. Madoff, once a respected figure on Wall Street, pleaded guilty to orchestrating the largest Ponzi scheme in history. His admission in a Manhattan courtroom marked the downfall of a financier who had previously served as chairman of Nasdaq and led an investment firm known for its seemingly steady returns. In reality, Madoff’s operation was a massive fraud, deceiving thousands of investors—including retirees, charities, and global financial institutions—out of an estimated $65 billion.

At 70 years old, Madoff confessed to 11 felony charges, including securities fraud, investment adviser fraud, wire fraud, and money laundering. Standing before U.S. District Judge Denny Chin, he admitted that his investment advisory business had been a sham for decades. “I am actually grateful for this opportunity to publicly explain what I did and take responsibility for my crimes,” Madoff stated, acknowledging that his firm had sustained itself by using money from new investors to pay returns to existing clients—a hallmark of a Ponzi scheme.

The scheme unraveled in December 2008, when Madoff admitted to his sons, who held executive roles at his firm, that his investment business was “one big lie.” They reported him to authorities, leading to his arrest on December 11. The timing was significant, as the 2008 global financial crisis likely accelerated the exposure of the fraud, with panicked investors attempting to withdraw funds that did not exist.

While Madoff claimed he acted alone, many doubted that such an intricate scheme could have been sustained for so long without assistance. Prosecutors later pursued charges against his associates, including accountants and employees who helped fabricate financial records to mislead investors.

Madoff’s guilty plea eliminated the need for a prolonged trial but offered little comfort to his victims, many of whom had lost their life savings. Some victims were present in court, expressing devastation and anger. “He ruined lives, and he deserves no mercy,” one defrauded investor said outside the courthouse.

Judge Chin immediately ordered Madoff into custody, denying his attorneys’ request for bail until sentencing. Citing the scale of the fraud, the potential flight risk, and the anguish of the victims, Chin ensured that Madoff left the courtroom in handcuffs.

On June 29, 2009, Madoff received a 150-year prison sentence, the maximum penalty under federal guidelines. Before sentencing, he expressed remorse, saying, “I live in a tormented state now, knowing of all the pain and suffering I have created.” However, few found his words meaningful, as most victims recovered only a fraction of their investments.

Madoff died in April 2021 while serving his sentence, leaving behind a legacy of financial devastation. His case spurred regulatory reforms, prompting stricter oversight of investment advisers and scrutiny of the Securities and Exchange Commission, which had ignored multiple warnings about his suspiciously consistent returns.

The Madoff scandal remains one of the most notorious financial frauds in history, serving as a stark reminder of the consequences of unchecked greed and the vulnerabilities of financial oversight.